With enthusiasm, let’s navigate through the intriguing topic related to The Green Rush: Sustainable Investing Takes Center Stage in Global Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

The Green Rush: Sustainable Investing Takes Center Stage in Global Markets

The world is changing. Climate change, social inequality, and environmental degradation are no longer abstract concepts; they are tangible realities impacting our lives and driving a seismic shift in the global financial landscape. This shift is fueled by a growing wave of investors, both individual and institutional, who are demanding more than just financial returns – they are demanding positive impact. This is the story of the burgeoning sustainable investing movement, a trend that is rapidly transforming global capital markets.

A Tidal Wave of Green Assets:

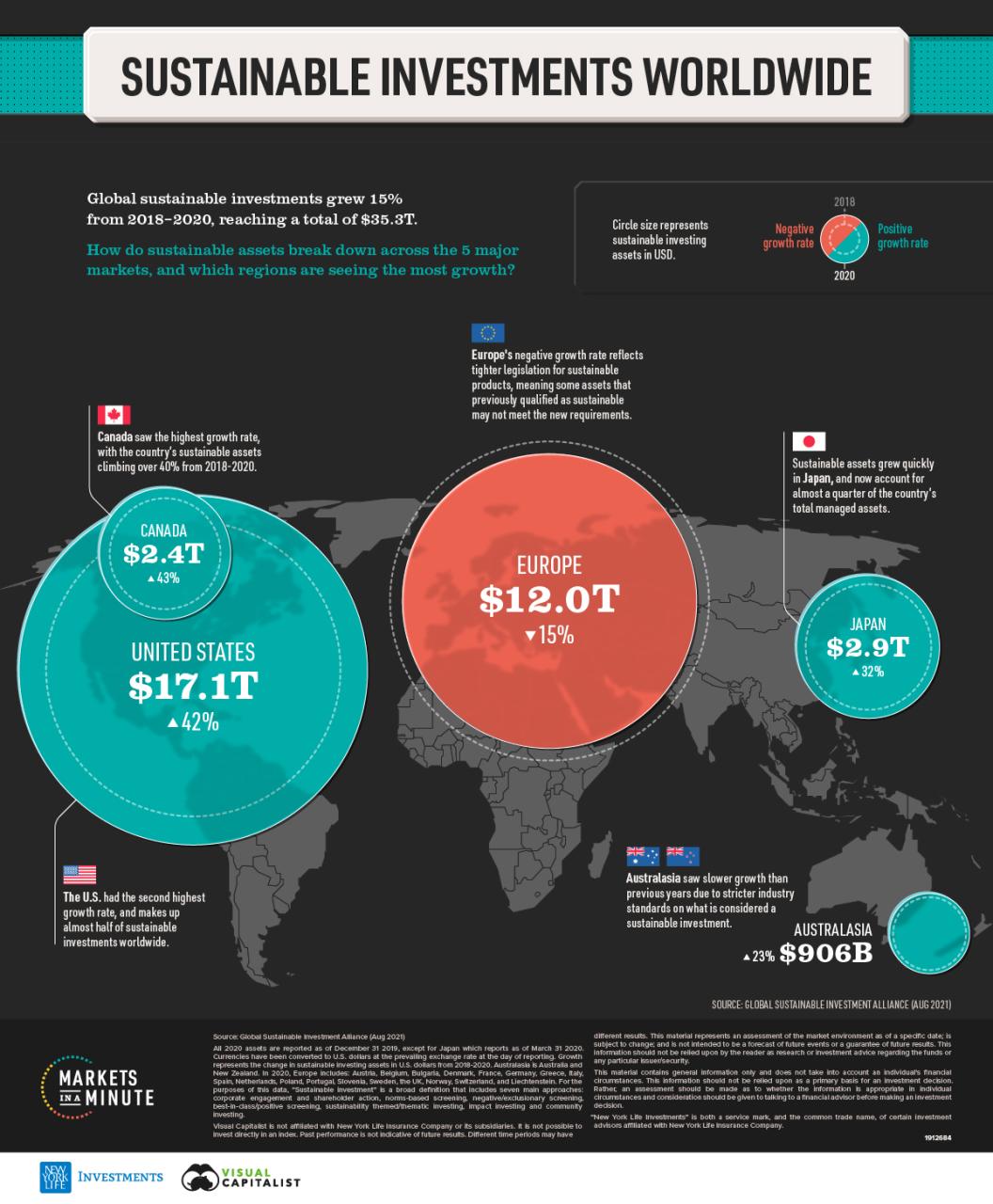

The numbers speak for themselves. The global sustainable investment market is booming, reaching a staggering USD 35.3 trillion in 2020, according to the Global Sustainable Investment Alliance (GSIA). This represents a staggering 36% increase from 2018, and the trend shows no signs of slowing down.

What’s driving this surge? A confluence of factors is pushing investors towards sustainable investments:

- Millennials and Gen Z: These generations are increasingly aware of the environmental and social challenges facing the planet, and they are demanding that their investments align with their values. A recent survey by Morgan Stanley found that 89% of millennials are interested in sustainable investing.

- Growing Regulatory Pressure: Governments around the world are increasingly enacting regulations that incentivize sustainable investing, such as carbon pricing mechanisms and mandatory ESG (Environmental, Social, and Governance) reporting.

- Investor Demand for Transparency and Accountability: Investors are demanding greater transparency from companies about their environmental and social impact. This has led to the emergence of ESG ratings agencies and the development of new reporting standards.

- The Business Case for Sustainability: Companies that prioritize sustainability are often more resilient and profitable in the long term. They tend to have lower operating costs, access to a wider pool of talent, and a stronger brand reputation.

- Technological Advancements: The development of new technologies, such as blockchain and artificial intelligence, is making it easier for investors to track and measure the impact of their investments.

The Green Rush: Sustainable Investing Takes Center Stage in Global Markets

Beyond the Hype: The Impact on Companies and Markets

The rise of sustainable investing is having a profound impact on companies and financial markets:

- Shifting Capital Flows: Investors are increasingly allocating capital to companies that are committed to sustainability, while divesting from those that are not. This is creating a new landscape for corporate finance, where sustainability is no longer a nice-to-have but a necessity.

- Increased Scrutiny and Accountability: Companies are facing increased scrutiny from investors, regulators, and the public about their environmental and social impact. This is leading to greater transparency and accountability, as companies are forced to address their sustainability shortcomings.

- Innovation and New Business Models: The demand for sustainable solutions is driving innovation and the emergence of new business models. Companies are developing new products and services that address environmental and social challenges, creating new opportunities for growth and investment.

- A New Era of Corporate Governance: Sustainable investing is pushing for a new era of corporate governance, where companies are held accountable not only to their shareholders but also to their stakeholders, including employees, customers, and communities.

Challenges and Opportunities

Despite the positive momentum, the sustainable investing movement faces several challenges:

- Greenwashing: Some companies are engaging in "greenwashing," making misleading claims about their sustainability practices. Investors need to be vigilant in identifying these companies and demanding transparency.

- Lack of Standardization: There is a lack of standardization in ESG reporting, making it difficult for investors to compare companies across different sectors and geographies.

- Data Availability: Data on companies’ environmental and social impact is often limited and unreliable, making it difficult for investors to make informed decisions.

Challenges and Opportunities

However, these challenges also present opportunities:

- Development of New Metrics and Standards: The need for standardization is driving the development of new metrics and standards for measuring ESG performance. This will improve transparency and accountability in the sustainable investing market.

- Green Shoots: Sustainable Investing Takes Root In Global Capital Markets

- Acorns Investing Reddit: Sustainable Investing Takes Root, Transforming Global Markets

- Investing In A Greener Future: The Rise Of Sustainable Investing And Top Podcasts To Tune In

- Sustainable Investing Takes Center Stage: Factor Investing Meets ESG

- A Green Tide: Sustainable Investing Takes Center Stage In Global Capital Markets

- Innovation in Data Analytics: New technologies are being developed to collect, analyze, and report on ESG data. This will make it easier for investors to identify companies with strong sustainability performance.

- Collaboration and Partnerships: Investors, companies, and governments are collaborating to address the challenges of sustainable investing. This collaboration is essential for building a more sustainable and equitable future.

Related Articles: The Green Rush: Sustainable Investing Takes Center Stage in Global Markets

Thus, we hope this article has provided valuable insights into The Green Rush: Sustainable Investing Takes Center Stage in Global Markets.

The Future of Sustainable Investing

The future of sustainable investing is bright. As the world faces the urgent need to address climate change, social inequality, and environmental degradation, investors are increasingly recognizing the importance of aligning their investments with their values. The growth of sustainable investing is not just a trend; it is a fundamental shift in the global financial landscape, creating a new paradigm for corporate governance, innovation, and impact.

The green rush is not just a wave; it is a tidal wave, transforming the way we invest, the way companies operate, and the way we shape the future of our planet. The challenge now is to harness this momentum, address the challenges, and ensure that sustainable investing becomes the mainstream, driving positive change for generations to come.

We hope you find this article informative and beneficial. See you in our next article!

cryptonias.my.id News Bisnis Technology Tutorial

cryptonias.my.id News Bisnis Technology Tutorial