In this auspicious occasion, we are delighted to delve into the intriguing topic related to Sustainable Investing Takes Center Stage: Investors Flock to Green Funds, Driving Market Change. Let’s weave interesting information and offer fresh perspectives to the readers.

Sustainable Investing Takes Center Stage: Investors Flock to Green Funds, Driving Market Change

The global capital markets are undergoing a seismic shift, fueled by a growing tide of investors seeking to align their portfolios with their values. Sustainable investing, once a niche pursuit, has exploded in popularity, with assets in sustainable funds reaching record highs and influencing everything from corporate behavior to the very structure of financial markets.

The Green Rush: Sustainable Funds Surge in Popularity

The numbers tell a compelling story. Global sustainable investment assets reached a staggering $41.1 trillion in 2022, according to the Global Sustainable Investment Alliance (GSIA). This represents a whopping 1/3 of all professionally managed assets worldwide, demonstrating the undeniable momentum of this trend.

This surge is driven by a confluence of factors, each playing a crucial role in shaping the future of investing:

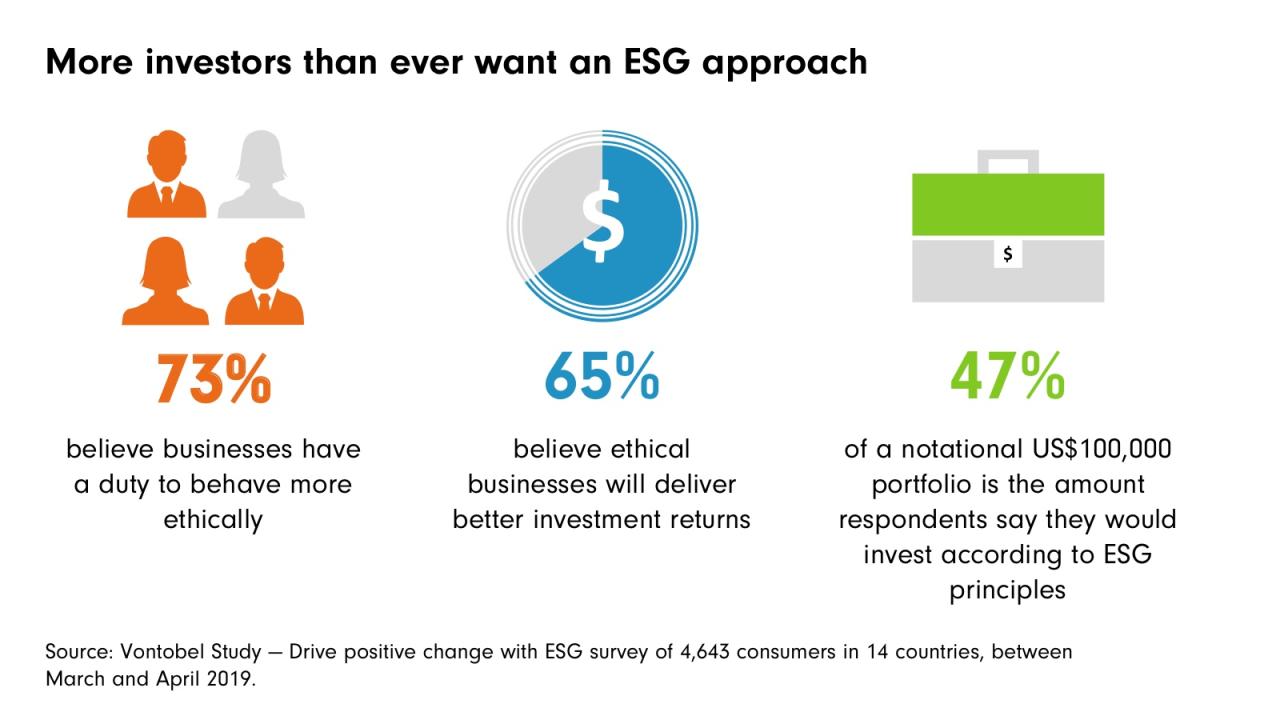

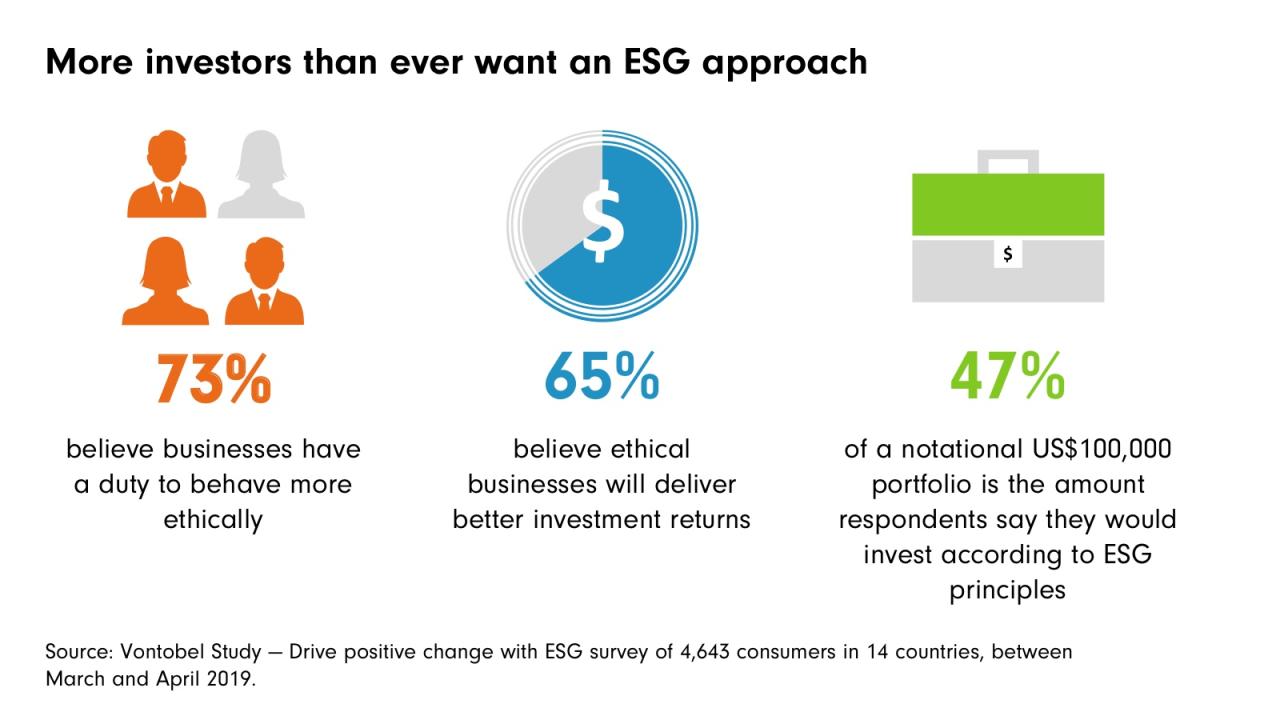

1. Growing Awareness of Environmental and Social Issues: The urgency of climate change, coupled with rising awareness of social inequalities, has sparked a wave of investor activism. Individuals and institutions alike are demanding that their investments reflect their commitment to a more sustainable future.

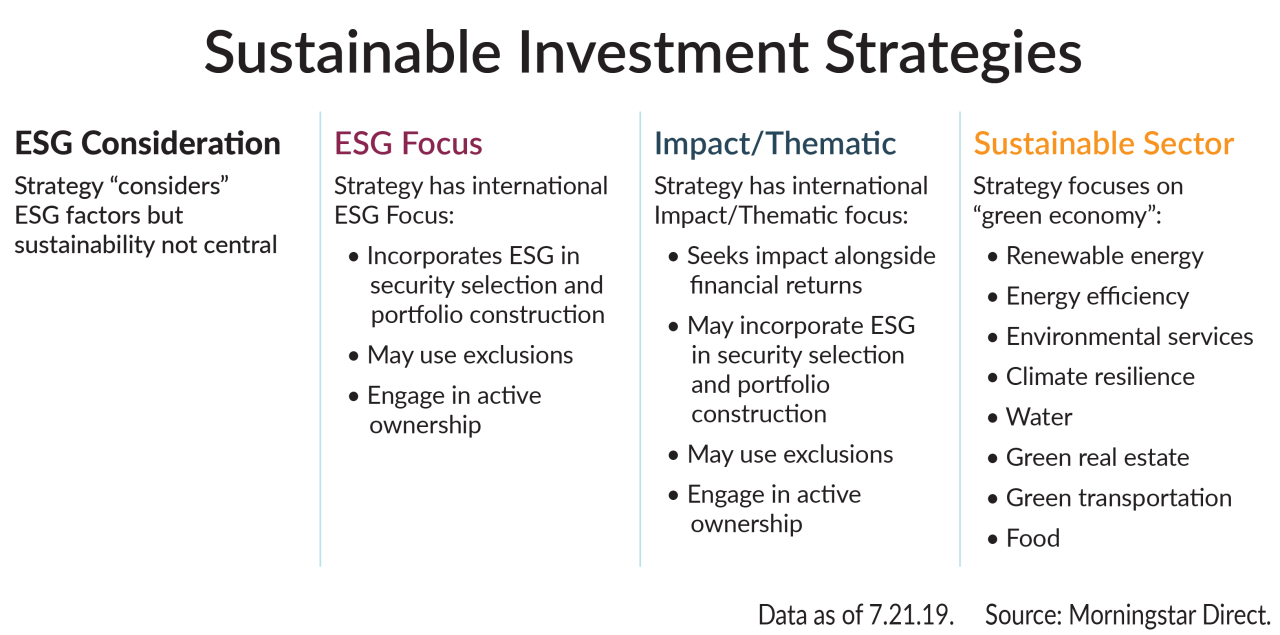

2. The Rise of Impact Investing: Impact investing goes beyond simply minimizing negative impacts; it actively seeks to generate positive social and environmental change. This approach appeals to investors who want to see tangible results from their investments, contributing to a better world while earning returns.

3. Increasing Regulatory Scrutiny: Governments and regulatory bodies are increasingly focused on promoting sustainable practices within financial markets. This includes stricter disclosure requirements for companies on their environmental, social, and governance (ESG) performance, as well as incentives for green investments.

4. Improved Data and Transparency: The availability of reliable data and standardized frameworks for assessing ESG performance has made it easier for investors to evaluate the sustainability credentials of companies and funds. This increased transparency fosters trust and confidence in the market.

5. The Growing Investor Base: Millennials and Gen Z, known for their strong social consciousness, are entering the investment arena with a clear preference for sustainable options. This demographic shift is further bolstering the demand for green investments.

Sustainable Investing Takes Center Stage: Investors Flock to Green Funds, Driving Market Change

Impact on Companies: A Shift in Corporate Behavior

The growing influence of sustainable investors is having a profound impact on corporate behavior. Companies are increasingly recognizing that their ESG performance is not just a matter of social responsibility, but a key driver of long-term value creation.

This shift is evident in:

- Increased ESG Reporting: Companies are facing mounting pressure to disclose their environmental and social impacts, leading to more comprehensive and transparent reporting practices.

- Focus on Sustainable Operations: Businesses are investing in renewable energy, reducing their carbon footprint, and adopting ethical labor practices to meet the growing demands of sustainable investors.

- Innovation in Sustainable Products and Services: Companies are developing new products and services that address environmental and social challenges, creating opportunities for growth and competitive advantage.

The Future of Financial Markets: Embracing Sustainability

The rise of sustainable investing is not just a trend; it’s a fundamental transformation of the financial landscape. As the demand for green investments continues to grow, we can expect to see:

- More Sustainable Investment Products: The market will see a proliferation of sustainable investment funds, ETFs, and other financial instruments catering to diverse investor needs and risk appetites.

- Integration of ESG Factors into Traditional Finance: ESG considerations will become increasingly integrated into traditional financial analysis, influencing investment decisions across asset classes.

- New Standards and Regulations: The development of standardized ESG reporting frameworks and regulations will further enhance transparency and accountability within the sustainable finance ecosystem.

- Shifting Investment Flows: Capital will increasingly flow towards companies and sectors with strong ESG performance, potentially leading to a reallocation of resources and a shift in market leadership.

- Fundamentals of Sustainable Real Estate: This module will delve into the key principles of sustainable real estate, covering topics like energy efficiency, water conservation, and responsible land use.

- Green Shoots: Sustainable Investing Takes Root In Global Capital Markets

- The Green Rush: How Sustainable Investing Is Reshaping The Real Estate Market

- Amazon’s AI Investment Fuels Sustainable Investing Boom: A Global Market Shift

- The Future Is Green: Why Early Investment In Sustainability Is A Winning Strategy

- Sustainable Investing: A Tidal Wave Of Capital Flows Into A Greener Future

- ESG Analysis in Real Estate: Learn how to assess the ESG performance of real estate investments, including environmental impact, social responsibility, and corporate governance.

- Sustainable Real Estate Investment Strategies: Explore various investment strategies tailored to the sustainable real estate market, from green bonds to impact-driven development projects.

- The Future of Sustainable Real Estate: Gain insights into emerging trends and opportunities in the evolving landscape of sustainable real estate, including the role of technology and innovation.

The Best Real Estate Investing Course: Navigating the Sustainable Landscape

In this rapidly evolving landscape, investors need to equip themselves with the knowledge and tools to navigate the complexities of sustainable investing. The "Best Real Estate Investing Course" will provide a comprehensive understanding of the following:

Related Articles: Sustainable Investing Takes Center Stage: Investors Flock to Green Funds, Driving Market Change

Thus, we hope this article has provided valuable insights into Sustainable Investing Takes Center Stage: Investors Flock to Green Funds, Driving Market Change.

Conclusion: A Sustainable Future for Investing

The rise of sustainable investing is not just a passing fad; it’s a fundamental shift in the way investors approach their portfolios. By aligning their investments with their values, investors are driving positive change in the world while pursuing financial returns. As this trend continues to gain momentum, the "Best Real Estate Investing Course" will provide you with the knowledge and skills to navigate this exciting and transformative landscape, contributing to a more sustainable future for both your investments and the planet.

We hope you find this article informative and beneficial. See you in our next article!

cryptonias.my.id News Bisnis Technology Tutorial

cryptonias.my.id News Bisnis Technology Tutorial