In this auspicious occasion, we are delighted to delve into the intriguing topic related to Green is the New Gold: Top Real Estate Investing Books Explore the Sustainable Investment Boom. Let’s weave interesting information and offer fresh perspectives to the readers.

Green is the New Gold: Top Real Estate Investing Books Explore the Sustainable Investment Boom

The global capital markets are undergoing a seismic shift, with investors increasingly seeking to align their portfolios with their values. Sustainable investing, once a niche pursuit, has become a mainstream movement, driven by a confluence of factors including climate change concerns, growing awareness of environmental, social, and governance (ESG) issues, and the realization that sustainable businesses often outperform their less responsible counterparts. This trend is particularly evident in the real estate sector, where investors are seeking out properties that meet stringent sustainability standards and offer long-term value.

The Rise of Sustainable Funds: A Green Tidal Wave

The growth of assets in sustainable funds is a testament to the burgeoning interest in this investment strategy. According to Morningstar, global sustainable fund assets reached a staggering $3.8 trillion in 2021, a 35% increase from the previous year. This surge reflects a growing demand for investment products that explicitly consider ESG factors, with investors recognizing the potential for both financial and societal returns.

Driving Forces: A Convergence of Concerns and Opportunities

Several factors are driving this surge in sustainable investment:

- Climate Change Awareness: The increasing awareness of climate change and its devastating effects has spurred investors to seek out businesses and assets that contribute to a sustainable future. This includes investing in renewable energy, energy-efficient buildings, and sustainable infrastructure.

- ESG Integration: Investors are increasingly incorporating ESG factors into their investment decisions. They are looking beyond financial metrics to assess a company’s environmental impact, social responsibility, and governance practices. This shift is driven by the recognition that responsible companies often outperform their less ethical peers.

- Regulatory Pressure: Governments and regulatory bodies are increasingly pushing for more transparent and sustainable investment practices. This includes mandatory ESG reporting requirements and incentives for sustainable investments.

- Investor Demand: Millennials and Gen Z, who are increasingly concerned about environmental and social issues, are driving the demand for sustainable investment products. They are seeking to align their investments with their values and contribute to a more sustainable future.

- Financial Performance: Studies have shown that companies with strong ESG practices often outperform their less responsible counterparts. This is due to factors such as reduced risk, improved operational efficiency, and enhanced access to capital.

Green is the New Gold: Top Real Estate Investing Books Explore the Sustainable Investment Boom

Impact on Companies and Financial Markets:

The increasing focus on sustainability is having a profound impact on companies and financial markets:

- Corporate Sustainability: Companies are being pressured to improve their ESG performance, leading to a shift towards more sustainable business practices. This includes reducing emissions, investing in renewable energy, and promoting diversity and inclusion.

- Investment Strategies: Investors are increasingly seeking out companies and assets with strong ESG credentials. This is leading to a revaluation of companies and a shift in investment strategies towards sustainable businesses.

- Market Volatility: The growing importance of ESG factors can lead to market volatility as investors adjust their portfolios to align with their values. Companies with poor ESG performance may face higher costs of capital and lower valuations.

- Innovation and Growth: The demand for sustainable solutions is driving innovation and growth in the green economy. This includes the development of new technologies, products, and services that address environmental and social challenges.

Real Estate: A Prime Target for Sustainable Investment

The real estate sector is particularly well-suited for sustainable investment. Buildings account for a significant portion of global greenhouse gas emissions, and there is a growing demand for energy-efficient and sustainable living spaces. As a result, investors are increasingly seeking out properties that meet stringent sustainability standards.

Top Real Estate Investing Books to Guide Your Journey

For investors interested in navigating the world of sustainable real estate, here are some top-rated books that provide valuable insights and guidance:

- "Green Real Estate Investing: A Guide to Profiting from Sustainable Development" by Eric J. Hemel

This book provides a comprehensive overview of the green real estate market, covering topics such as energy efficiency, renewable energy, and sustainable building materials. It also explores the financial benefits of investing in sustainable properties and provides practical advice for investors. - "Sustainable Real Estate Investing: A Guide to Creating Value and Impact" by Michael J. Bernard

This book focuses on the intersection of sustainability and real estate investing, offering a framework for evaluating and investing in sustainable properties. It also explores the role of ESG factors in real estate investment decisions and provides case studies of successful sustainable real estate projects. - Investing In A Greener Future: The Rise Of Sustainable Investing And Top Podcasts To Tune In

- Sustainable Investing Takes Center Stage: A Look At The Books Driving The Trend

- "The Green Real Estate Handbook: A Practical Guide to Building and Investing in Sustainable Properties" by James P. Wallace

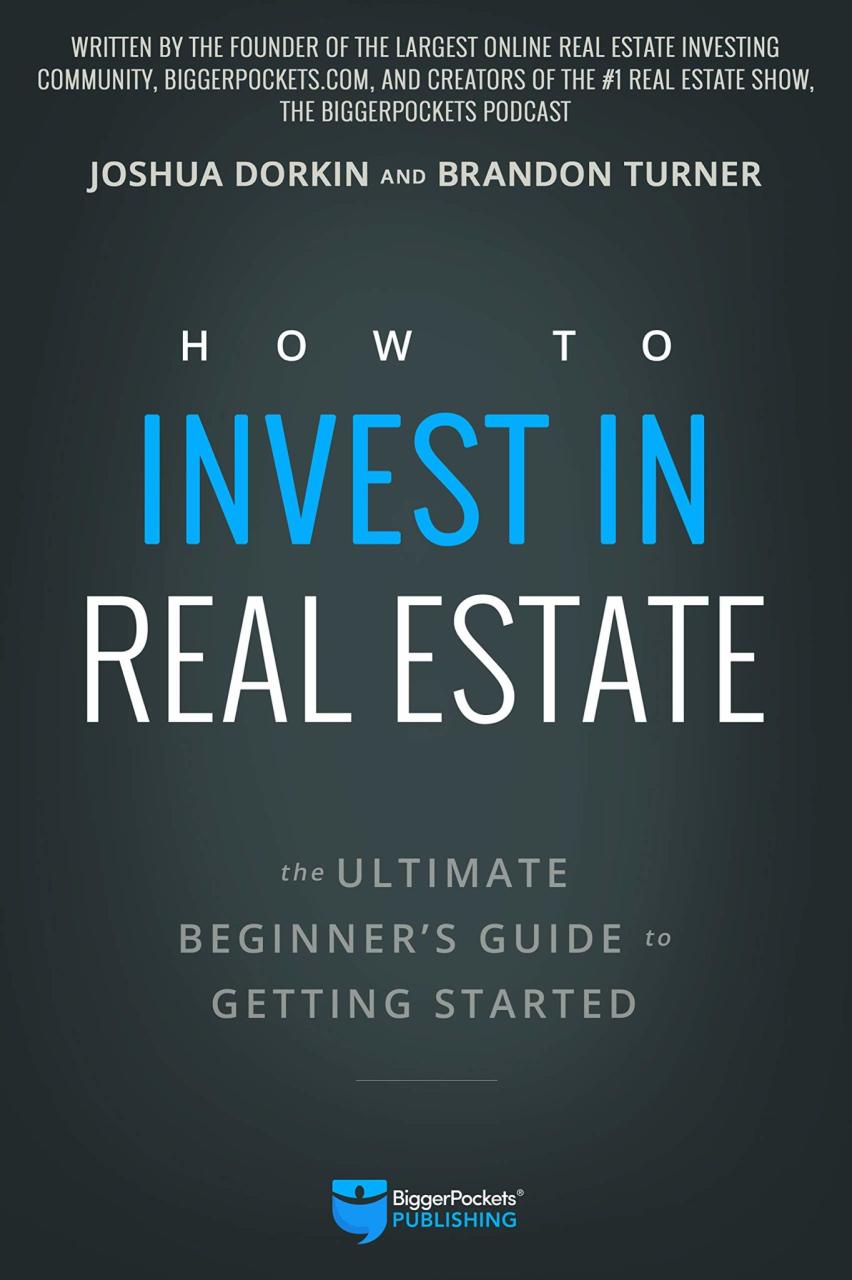

This book provides a practical guide to building and investing in sustainable properties, covering topics such as green building standards, energy efficiency, and renewable energy. It also explores the financial benefits of sustainable real estate and offers advice for investors. - "Real Estate Investing for Dummies" by Eric Tyson

While not specifically focused on sustainable investing, this comprehensive guide covers all aspects of real estate investing, including property analysis, financing, and legal considerations. Investors can use this knowledge to identify sustainable properties that meet their investment goals. - "Investing in Sustainable Real Estate: A Guide to Creating Value and Impact" by David J. Pinsky

This book explores the growing demand for sustainable real estate and provides a framework for evaluating and investing in sustainable properties. It also discusses the financial and social benefits of investing in sustainable real estate and offers case studies of successful sustainable real estate projects.

Related Articles: Green is the New Gold: Top Real Estate Investing Books Explore the Sustainable Investment Boom

Thus, we hope this article has provided valuable insights into Green is the New Gold: Top Real Estate Investing Books Explore the Sustainable Investment Boom.

Investing in a Sustainable Future

The rise of sustainable investing is a positive development for both investors and the planet. By aligning their portfolios with their values, investors can contribute to a more sustainable future while also potentially generating strong financial returns. The real estate sector offers a wealth of opportunities for investors seeking to make a positive impact, and the books mentioned above provide valuable resources for navigating this evolving landscape. As the demand for sustainable investments continues to grow, investors who embrace this trend are well-positioned to capitalize on the opportunities and contribute to a more sustainable future.

We hope you find this article informative and beneficial. See you in our next article!

cryptonias.my.id News Bisnis Technology Tutorial

cryptonias.my.id News Bisnis Technology Tutorial