With enthusiasm, let’s navigate through the intriguing topic related to Sustainable Investing Takes Center Stage: A Look at the Books Driving the Trend. Let’s weave interesting information and offer fresh perspectives to the readers.

Sustainable Investing Takes Center Stage: A Look at the Books Driving the Trend

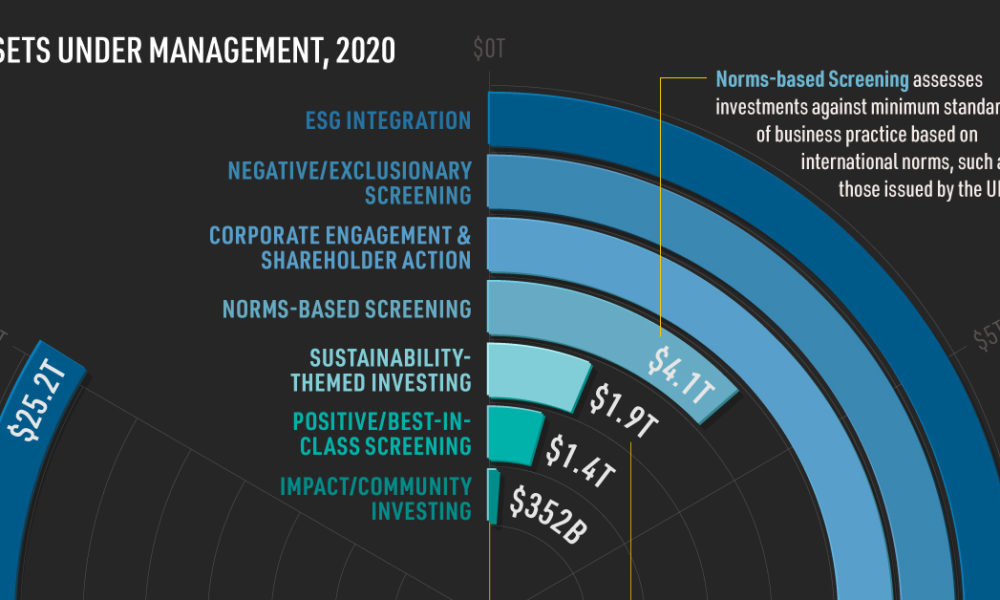

The global capital markets are undergoing a seismic shift, driven by a growing awareness of environmental, social, and governance (ESG) factors. Investors, no longer content with solely maximizing returns, are increasingly seeking investments that align with their values and contribute to a more sustainable future. This trend, dubbed "sustainable investing," is gaining momentum, attracting billions of dollars in assets and impacting companies and financial markets in profound ways.

The Rise of Sustainable Funds:

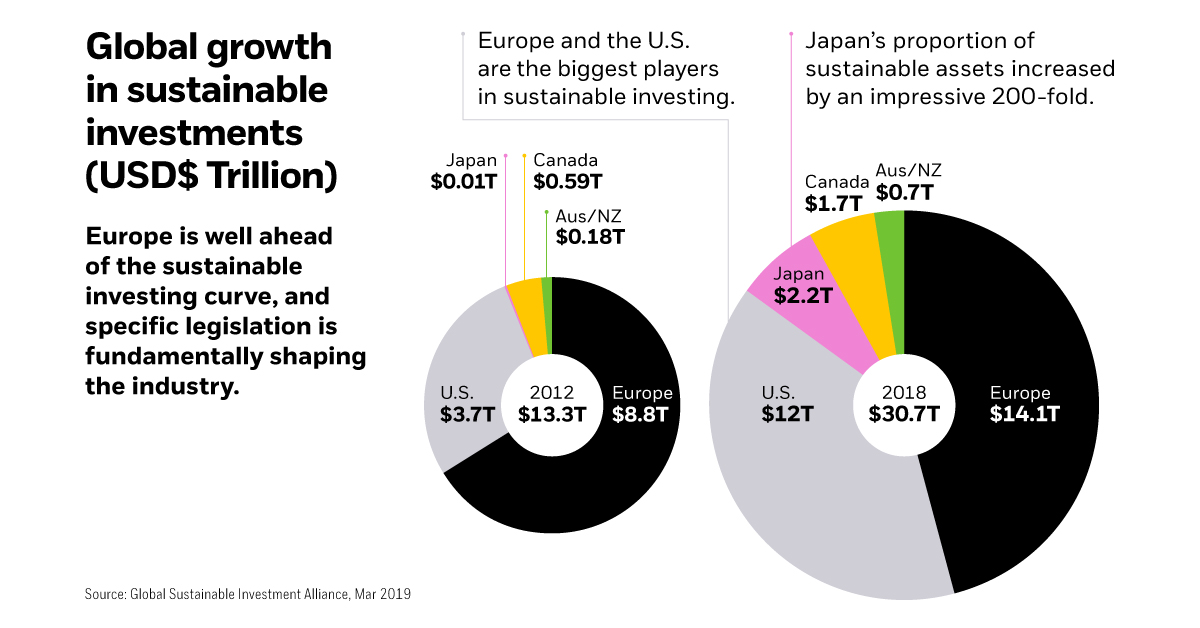

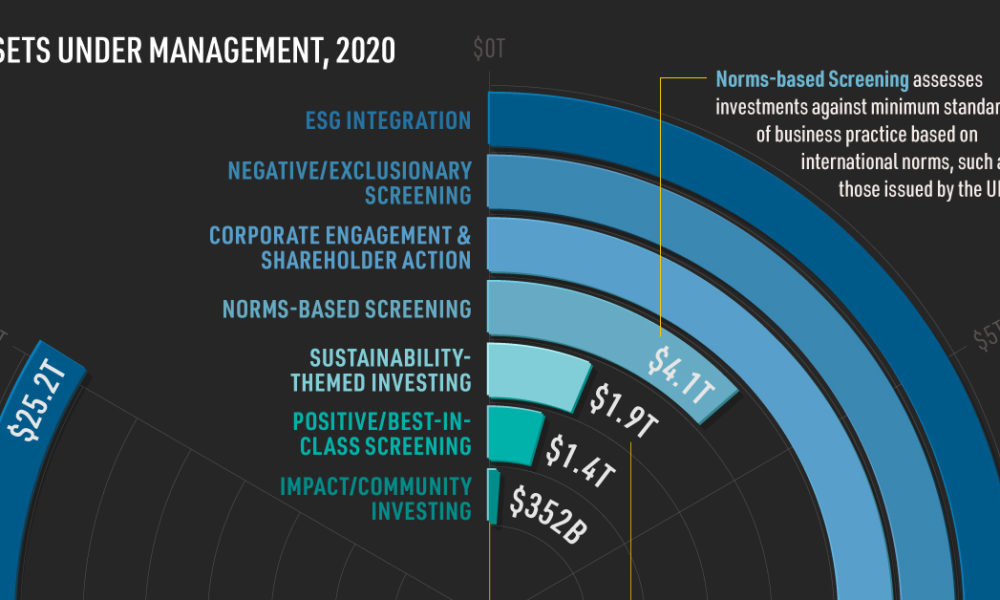

The growth of sustainable investment is reflected in the burgeoning asset pool of sustainable funds. According to Morningstar, global sustainable fund assets reached a record $3.8 trillion in 2022, representing a 35% increase from the previous year. This growth trajectory is expected to continue, with analysts predicting that sustainable investing will become the dominant investment strategy in the coming years.

This surge in interest is not limited to a specific demographic or geographical region. From individual investors seeking to make a positive impact to institutional investors managing large portfolios, the demand for sustainable investment options is expanding across the board. This widespread adoption underscores the increasing importance of ESG factors in investment decision-making.

Factors Driving the Sustainable Investing Boom:

Several key factors are driving the rapid growth of sustainable investing:

- Growing Environmental Awareness: Climate change and its devastating consequences have become undeniable realities, prompting individuals and institutions to seek investments that promote environmental sustainability. This has led to an increased focus on companies with strong environmental records, including those reducing their carbon footprint, investing in renewable energy, and promoting sustainable practices.

- Societal Concerns and Ethical Considerations: Concerns over social issues like inequality, human rights abuses, and labor exploitation have also contributed to the rise of sustainable investing. Investors are demanding transparency and accountability from companies on their social impact, leading to increased investment in businesses that prioritize ethical practices and promote social good.

- Growing Regulatory Pressure: Governments and regulatory bodies are increasingly recognizing the importance of sustainable investing and enacting policies to encourage responsible investment practices. This includes introducing mandatory ESG reporting requirements for companies, promoting green finance initiatives, and incentivizing sustainable investments.

- Improved Investment Performance: Contrary to the perception that sustainable investing compromises returns, studies have shown that sustainable funds can outperform traditional investment strategies over the long term. This finding is attributed to the fact that companies with strong ESG practices often exhibit better risk management, operational efficiency, and long-term growth potential.

- Technological Advancements: The rise of fintech and data analytics has enabled investors to access more information about the ESG performance of companies, making it easier to identify and invest in sustainable businesses. This increased transparency and accessibility have further fueled the growth of sustainable investing.

Sustainable Investing Takes Center Stage: A Look at the Books Driving the Trend

Impact on Companies and Financial Markets:

The growing influence of sustainable investing is having a significant impact on companies and financial markets:

- Increased Scrutiny and Reporting: Companies are facing increasing pressure to disclose their ESG performance and demonstrate their commitment to sustainability. This has led to the development of standardized ESG reporting frameworks and increased scrutiny from investors and stakeholders.

- Shift in Capital Allocation: Investors are directing capital towards companies with strong ESG credentials, leading to a shift in capital allocation towards sectors and industries that promote sustainability. This is incentivizing companies to adopt more sustainable practices and invest in green technologies.

- Increased Competition and Innovation: The growing demand for sustainable investment options is driving competition among companies to improve their ESG performance and develop innovative solutions that address environmental and social challenges. This has led to a surge in green technologies, sustainable business models, and innovative investment products.

- Redefining Investment Strategies: Sustainable investing is forcing financial institutions to rethink their investment strategies and incorporate ESG factors into their portfolio management decisions. This is leading to the development of new investment products and services specifically designed for sustainable investors.

- Long-Term Value Creation: By promoting sustainable practices and investing in companies with strong ESG credentials, sustainable investing aims to create long-term value for investors and society as a whole. This approach focuses on building a more resilient and equitable future, addressing pressing global challenges like climate change and social inequality.

The Role of Books in Shaping the Sustainable Investment Landscape:

The growing interest in sustainable investing is reflected in the increasing number of books exploring the subject. These books provide investors with valuable insights into the principles, strategies, and opportunities within this emerging field. Here are some of the top investing books that offer a comprehensive overview of sustainable investing:

1. "ESG Investing: A Guide for Investors" by David Blitz and John A. Haslem: This book provides a detailed analysis of the ESG framework, exploring its impact on investment decisions and the potential benefits of incorporating ESG factors into portfolio management.

2. "The Sustainable Investor’s Handbook: A Guide to Building a Sustainable Portfolio" by David Wei: This comprehensive guide offers practical strategies for investors seeking to build a sustainable portfolio, covering topics like identifying sustainable investments, evaluating ESG performance, and managing risk.

3. "Investing in a Time of Climate Change: How to Navigate the New World of Sustainable Finance" by Michael Brune and John Fullerton: This book examines the financial risks and opportunities associated with climate change, providing investors with a roadmap for navigating the evolving landscape of sustainable finance.

4. "The Impact Investor: How to Make Money and Make a Difference" by Jed Emerson: This book explores the concept of impact investing, which aims to generate both financial returns and positive social or environmental impact. It provides practical guidance on identifying and evaluating impact investments.

5. "Sustainable Investing: The Next Generation of Investing" by Andrew Winston and Patrick C. Sheehan: This book offers a forward-looking perspective on sustainable investing, examining the emerging trends and innovations shaping the future of this field.

Related Articles: Sustainable Investing Takes Center Stage: A Look at the Books Driving the Trend

Thus, we hope this article has provided valuable insights into Sustainable Investing Takes Center Stage: A Look at the Books Driving the Trend.

Conclusion:

The rise of sustainable investing is a testament to the growing awareness of environmental and social issues and the desire to align investment decisions with values. This trend is transforming the global capital markets, impacting companies, financial institutions, and investors alike. As the demand for sustainable investment options continues to grow, books play a crucial role in educating investors and providing them with the knowledge and tools to navigate this evolving landscape. By embracing sustainable investing, we can collectively contribute to a more sustainable and equitable future.

We appreciate your attention to our article. See you in our next article!

cryptonias.my.id News Bisnis Technology Tutorial

cryptonias.my.id News Bisnis Technology Tutorial