In this auspicious occasion, we are delighted to delve into the intriguing topic related to Sustainable Investing Takes Center Stage: Schwab’s Automatic Investing Platform Reflects Growing Investor Demand. Let’s weave interesting information and offer fresh perspectives to the readers.

Sustainable Investing Takes Center Stage: Schwab’s Automatic Investing Platform Reflects Growing Investor Demand

The global financial landscape is undergoing a dramatic shift, driven by a surge in investor interest towards sustainable investing. This trend is not just a passing fad; it’s a fundamental realignment of values, with investors increasingly demanding that their portfolios align with their ethical and environmental convictions. Schwab’s automatic investing platform, a testament to this evolving market, is seeing a significant uptick in demand for sustainable investment options, reflecting a broader movement across capital markets.

A Tsunami of Sustainable Assets

The growth of assets in sustainable funds paints a compelling picture of this trend. According to Morningstar, global sustainable fund assets surged past $3.8 trillion in 2022, marking a 23% year-over-year increase. This surge signifies a growing appetite for investments that promote environmental, social, and governance (ESG) principles.

Driving Forces Behind the Sustainable Investment Boom

Several factors are converging to fuel this unprecedented growth in sustainable investing:

- Millennial and Gen Z Investors: This younger generation, known for its social consciousness and strong environmental convictions, is entering the investment landscape with a clear preference for sustainable options. They are actively seeking investments that align with their values and contribute to a better future.

- Growing Awareness of Climate Change: The escalating impacts of climate change are raising alarm bells globally, driving individuals and institutions to seek investments that mitigate environmental risks and contribute to a sustainable future.

- Regulatory Pressure and Policy Support: Governments and regulatory bodies worldwide are increasingly prioritizing sustainability in financial markets. This includes introducing regulations that incentivize sustainable investing and require companies to disclose their ESG performance.

- Performance Considerations: Research suggests that sustainable investments can deliver competitive returns. Studies have shown that companies with strong ESG practices often exhibit better financial performance and resilience, making them attractive to investors seeking both ethical and profitable options.

- Corporate Social Responsibility (CSR) and Stakeholder Engagement: Companies are increasingly recognizing the importance of integrating ESG principles into their operations. This shift is driven by stakeholder demands, including investors, employees, and customers, who are increasingly scrutinizing companies’ environmental and social impact.

Sustainable Investing Takes Center Stage: Schwab’s Automatic Investing Platform Reflects Growing Investor Demand

Schwab’s Automatic Investing Platform: Embracing the Sustainable Investing Revolution

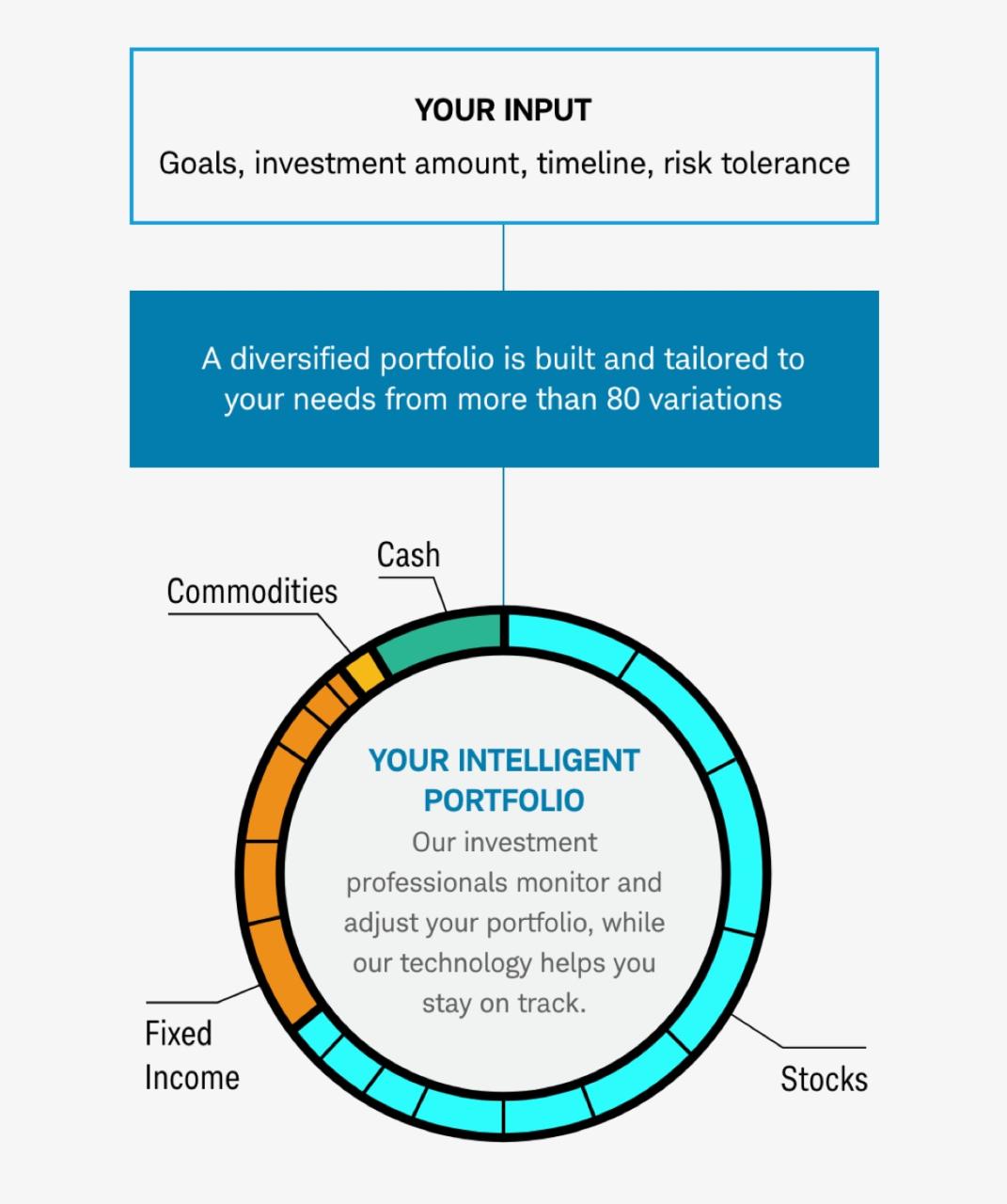

Schwab’s automatic investing platform, known for its user-friendly interface and diversified investment options, is responding to this growing demand by offering a range of sustainable investment choices. The platform allows investors to choose from a variety of ESG-focused portfolios, enabling them to align their investments with their values without sacrificing potential returns.

Impact on Companies and Financial Markets

The rise of sustainable investing is having a profound impact on both companies and financial markets:

- Increased Scrutiny and Reporting Requirements: Companies are facing increased scrutiny regarding their ESG performance, with investors and stakeholders demanding transparency and accountability. This is leading to a greater emphasis on ESG reporting and data disclosure.

- Shifting Capital Flows: Investors are increasingly directing their capital towards companies with strong ESG credentials. This is creating a significant competitive advantage for companies that prioritize sustainability and are demonstrably committed to positive social and environmental impact.

- Innovation and Growth in Sustainable Industries: The influx of capital into sustainable industries is fostering innovation and accelerating the development of new technologies and solutions addressing climate change and social challenges.

- New Investment Opportunities: The growing demand for sustainable investment options is creating new opportunities for financial institutions and asset managers to develop innovative products and services that cater to the evolving needs of investors.

The Future of Sustainable Investing

The momentum behind sustainable investing is undeniable. The trend is expected to continue its upward trajectory, driven by a confluence of factors, including generational shifts, growing awareness of climate change, and regulatory support. As investors increasingly prioritize both returns and impact, sustainable investing will continue to reshape the global financial landscape, driving positive change for companies, communities, and the planet.

Implications for Investors

For investors seeking to align their portfolios with their values and contribute to a sustainable future, Schwab’s automatic investing platform provides a convenient and accessible entry point into the world of sustainable investing. Here’s how the platform can benefit investors:

- Diversified Portfolios: Investors can choose from a range of ESG-focused portfolios that align with their specific risk tolerance and investment goals.

- Automated Rebalancing: The platform automates portfolio rebalancing, ensuring that investors maintain their desired asset allocation and minimize risk.

- Sustainable Investing: A Tidal Wave Of Capital Flows Into A Greener Future

- Sustainable Investing: A Green Tide Sweeping Global Markets

- Sustainable Investing Takes Center Stage: A Look At The Books Driving The Trend

- Investing In A Greener Future: The Rise Of Sustainable Investing And Top Podcasts To Tune In

- Value Investing Meets Sustainability: A New Era Of Investing In The Global Capital Markets

- Low Fees: Schwab’s automatic investing platform offers low fees, making sustainable investing accessible to a wider range of investors.

- Transparency and Reporting: Investors can track their portfolio’s performance and access detailed ESG reports, providing insights into the environmental and social impact of their investments.

Related Articles: Sustainable Investing Takes Center Stage: Schwab’s Automatic Investing Platform Reflects Growing Investor Demand

Thus, we hope this article has provided valuable insights into Sustainable Investing Takes Center Stage: Schwab’s Automatic Investing Platform Reflects Growing Investor Demand.

Conclusion

The rise of sustainable investing is a powerful testament to the evolving relationship between finance and society. As investors prioritize both returns and impact, Schwab’s automatic investing platform is poised to play a key role in this transformative trend, empowering individuals to invest in a more sustainable and equitable future. By embracing sustainable investing, investors can not only contribute to positive change but also build portfolios that align with their values and potentially generate strong returns.

We appreciate your attention to our article. See you in our next article!

cryptonias.my.id News Bisnis Technology Tutorial

cryptonias.my.id News Bisnis Technology Tutorial